What to Do When You are Involved in a Car Accident

Malaysian roads are fraught with accidents, and even if you drive carefully, there will always be someone driving recklessly and endangering others.

For this reason, the Malaysian government enacted the Road Transport Act 1987 to protect all road users and vehicles. This law, enforced by the Ministry of Transport, the Road Transport Department, and the Royal Malaysian Police, is intended to prevent accidents due to negligence and reckless driving.

However, despite the authorities' best efforts to create safer roads, the number of road accidents that occur every year remains alarmingly high. Malaysia reported 418,237 road accidents and 4,634 accident mortality in 2020 alone. This translates to about 13 people killed every day due to unsafe driving in 2020.

Whether or not a road accident results in a fatality, its consequences are no less significant. Even if you are not at fault in a motor vehicle accident, you must still go to the police station and notify your insurer. Additionally, you will not be able to use your vehicle while it is being repaired. It would be worse if you are injured.

We can conclude that being involved in a motor accident is at the very least a frustrating and time-consuming experience.

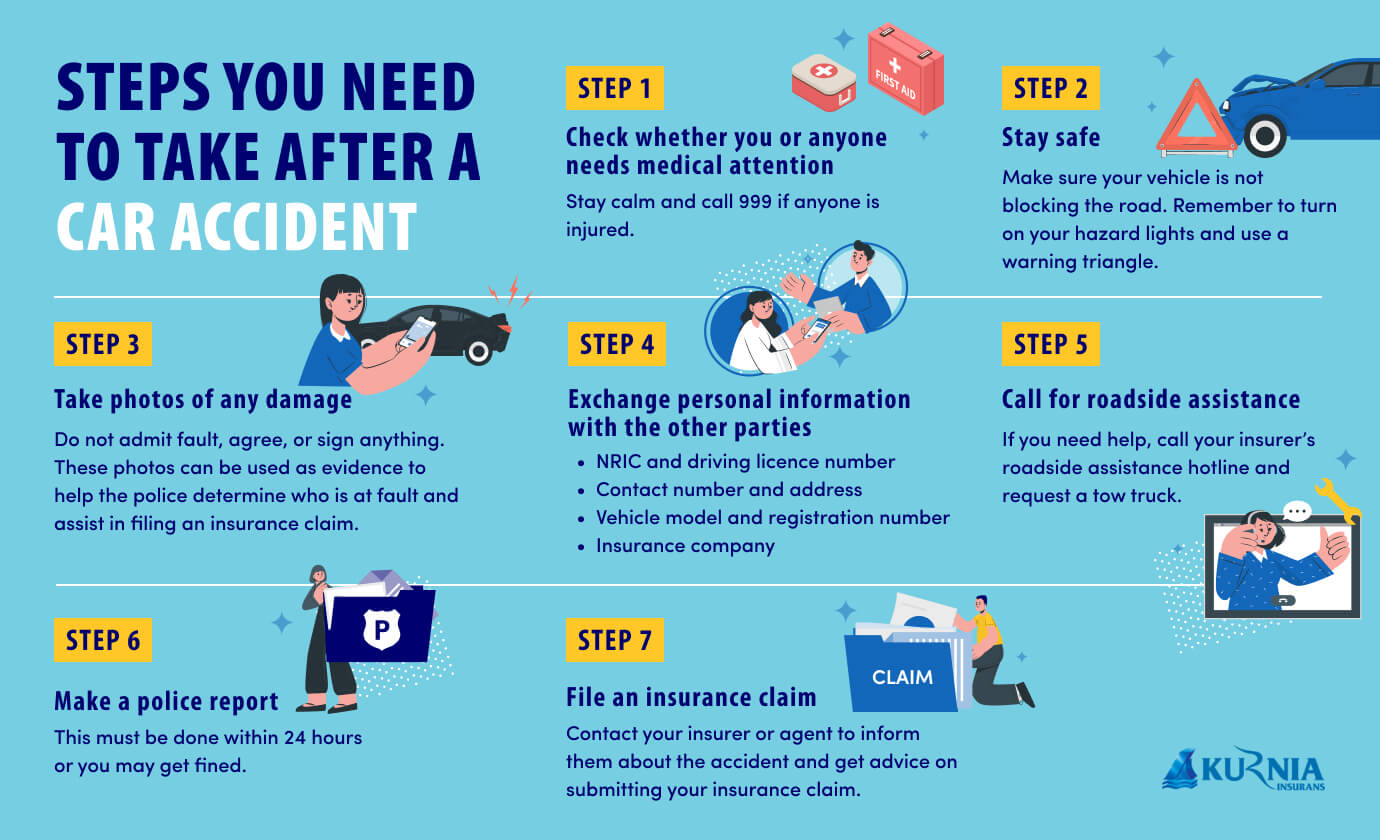

If you are unfortunate enough to get into a road accident, what should you do? The following is a comprehensive explanation to help prepare you for the unexpected on the road.

1. Assess whether you need medical assistance

First of all, don't panic and remain calm. Check yourself, your fellow passengers, and the other party for injuries. Call 999 immediately to request assistance if you see anyone who needs medical attention.

2. Take note of your surroundings and make sure you're safe

Your vehicle should not block the road. If it does, it should be moved safely. Oncoming drivers may not be able to see that you've stopped. Keeping a safe distance from other vehicles can lessen the chance of causing a traffic jam or another collision.

In case of an accident involving another driver, both need to move to the side of the road. It is still important to use your hazard lights and a warning triangle, even after you have moved to the side of the road.

Once you have repositioned the vehicle, turn off the engine to prevent further damage.

If angry mob forms or you encounter a road bully harassing you, don't get out of the car and instead drive straight to the police station. The law prohibits road bullying, so if you fear for your safety, you should head to the police station immediately and lodge a report.

3. Document any damage to your vehicle

Once you have confirmed that it is safe to get out of your vehicle, assess it properly for damage. Discuss any damages to both of the vehicles with the other party. Remember to be polite, do not get into an argument, admit fault or sign anything.

You should always take photos of the accident scene and damage caused to all vehicles involved whenever possible. These photos will make an important supplement to the police report.

Ensure that you have all these details documented, as they can serve as evidence:

- Any visible damage to the vehicle (yours and the other party's).

- Close-ups of any visible damages to the vehicle (yours and other party's).

- The presence of physical marks (if any) such as skid marks, damaged lamp posts, potholes, or damaged road barriers.

- Road names or landmarks in the area.

- If you have a dashboard camera, save the video footage to give to the police later.

- Write down the time the accident occurred.

- Note the orientation of the vehicles.

4. Exchanging personal information with the other parties

It is crucial to record the personal particulars of all drivers involved in the crash since this will speed up the police report filing process. If the other party decides to commit a hit-and-run or refuses to report it, you will be protected, and you can claim from their insurer.

You should have:

- Name, address, and phone number of the driver.

- Identification number and driving licence number.

- Make, model, colour, and registration number of the vehicle.

- Other witnesses' contact information (if any).

- The insurance company name for the other vehicle.

5. For roadside assistance service, call your insurance company's hotline

Call your insurer or insurance agent immediately if you discover your car cannot be driven and needs to be towed. The insurance company will ask you a few simple questions about the accident and arrange for a tow truck to go to the location and tow your vehicle to a nearby panel workshop.

If your car is still roadworthy, head to the nearest police station to file a report before heading to the nearest panel workshop.

Beware of tow truck scams. You will often see people approach you out of nowhere at the scene of accidents and suggest a workshop to fix your car quickly and cheaply. Sometimes they will offer towing service. It is best not to entertain them since they will likely charge you exorbitant towing fees or overcharge you for repairs.

If you have an insurance policy with Kurnia, we offer free 24-hour roadside assistance for your vehicle, whether it has suffered a breakdown or been involved in an accident. Contact our Hotline at 1 800 88 3833, and someone will assist you immediately. You can also download our One Touch mobile app on your phone. With the One Touch app, you can find your nearest panel workshop and request road assistance with a single click of the SOS button.

6. Lodge a police report within 24 hours

To file a report, go to the nearest police station that has a traffic department. This must be done within 24 hours of the accident unless there is a valid reason (such as being hospitalised or receiving treatment for your injuries) that can be supported by an official medical report. A police summons may result otherwise. By filing a police report, you protect yourself against any unexpected third-party motor claims or personal injury claims.

As part of the process, you must provide details of the accident and any other evidence. Following the police investigation, the summons will be issued to the person at fault. Make sure to get a certified copy of the report, as you may need it when you file an insurance claim.

7. Register an insurance claim

If you are not at fault:

If your vehicle is damaged, you can either reach an agreement with the other driver or file an insurance claim.

If you decide to make an insurance claim you have two choices depending on your insurance coverage: You could claim from the third-party insurer directly or speed up the process by initiating an Own Damage Knock-for-Knock (OD KFK) claim.

OD KFK claim is a hassle-free way of claiming from your own insurer and not having to deal directly with the third-party insurer. An OD KFK claim also protects your NCD (except in certain scenarios) because you are not at fault. NCDs are motor insurance discounts you receive if you or a third party has not made any claims under your policy. They can significantly lower your annual premiums.

However, you will need to provide additional documents to your insurer such as a third party police report, police investigation result and the police sketch plan to ensure a successful claim without affecting your NCD.

Once you have filed a claim, a loss adjuster or investigator will inspect your vehicle. Upon assessing the damage and repair costs, the insurer will notify you of the amount you can claim.

If you're at fault:

If the damage is minor and there is no bodily injury, most people will prefer to settle privately with the other party than file a claim with their insurer and lose their No-Claim Discount (NCD).

Depending on the severity of the damage, the other party can file an OD KFK claim with their insurer or a Third Party Property Damage (TPPD) claim with your insurer. You can also file Own Damage claims with your insurer if your vehicle is damaged in the accident, but you are likely to lose your NCD.

What about fender benders?

Fender benders are generally considered minor accidents, usually at low speeds, so the damage is minimal.

When you're involved in a fender bender, it's good to notify your insurer no matter how minor the accident is, even if a private agreement has been reached. If you do so, you can protect yourself from the other driver turning around and suing you for personal injury or property damage.

For Kurnia customers, visit our Claims Centre to get the latest information on our claims process.

Disclaimer: This blog post is strictly for informational purposes, and should not be taken as advice of any kind. Kurnia disclaims all responsibility for any losses resulting from reliance on the information contained in this article.